On January 31, 2024, the U.S. House of Representatives passed the Tax Relief for American Families and Workers Act of 2024, introducing significant tax changes that are poised to benefit business owners and real estate investors. Now, the bill awaits action in the Senate, which resumed work on February 27, 2024. As discussions continue, many Senators are considering adjustments to the current text, with a strong possibility that this bill may be bundled with an appropriations bill, as key government funding deadlines approach on March 1st and 8th.

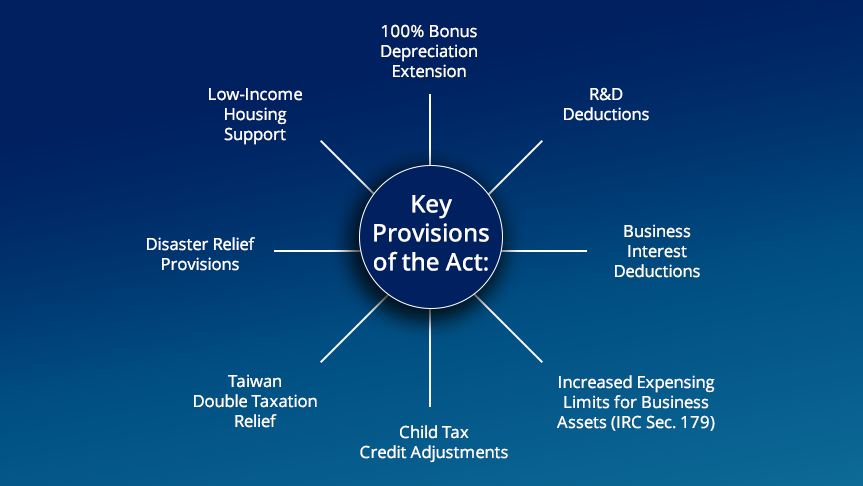

100% Bonus Depreciation Extension

One of the most anticipated elements of the bill is the extension of 100% bonus depreciation. This provision pushes the beginning of the phase-out from 2023 to 2026, allowing businesses to continue taking full advantage of depreciation on qualifying assets. Without the extension, the depreciation percentage drops to 80% in 2023 and 60% in 2024.

R&D Deductions

The bill reverses the 2022 rule requiring companies to amortize domestic R&D costs over five years and foreign costs over 15 years. Immediate expensing of R&D costs is expected to return.

Business Interest Deductions

A shift in the method for calculating net interest expense would occur, switching back to the earnings before interest, taxes, depreciation, and amortization (EBITDA) standard for taxable years starting after December 31, 2023.

Increased Expensing Limits for Business Assets (IRC Sec. 179)

Businesses may also see increased caps on the amount they can expense on depreciable business assets, providing another avenue for immediate tax savings.

Child Tax Credit Adjustments

In an effort to provide more relief to families, the child tax credit will be adjusted for inflation in 2024 and 2025. Additionally, the maximum partial refundability will rise incrementally from $1,800 in 2023 to $2,000 in 2025.

Taiwan Double Taxation Relief

The bill introduces provisions to prevent double taxation between the United States and Taiwan, streamlining tax obligations for businesses operating in both countries.

Disaster Relief Provisions

For those affected by disasters, the bill extends tax treatment for personal casualty losses, excludes wildfire compensation from income, and allocates specific funding for disaster relief in East Palestine, Ohio.

Low-Income Housing Support

The low-income housing tax credit ceiling will increase for 2023-2025, with the bond-financing threshold being reduced to 30%.

1099 Reporting Thresholds

For independent contractors and other non-employees, the reporting threshold for 1099-NEC and 1099-MISC forms will rise from $600 to $1,000.

Employee Retention Credit (ERC) Changes

No ERC claims will be allowed after January 31, 2024. Additionally, the bill gives the IRS more authority in auditing and penalizing fraudulent ERC claims.

The bill, though promising, is far from final. Senators are debating whether the legislation will pass as a stand-alone bill or be tied to broader appropriations measures. If tied to appropriations, it may face a more complicated path forward. As of now, the Senate is targeting mid-April for a vote.

Since many of these tax changes would be retroactive to 2023, we recommend consulting your tax advisor about filing an extension to account for any Senate decisions that may affect your tax planning. ZSS CPA will continue to monitor the developments and update you as the bill progresses.

27200 Tourney Road, Suite 290

Valencia, CA 91355-5906

MORE INFORMATION