If you’re a high-income earner with real estate investments—or you’re planning to get into real estate—there’s a powerful tax-saving strategy you should know about: the Real Estate Professional Status (REPS). At ZSS CPA, we help clients leverage this strategy to significantly reduce their tax burden and build long-term wealth.

If you’re a high-income earner with real estate investments—or you’re planning to get into real estate—there’s a powerful tax-saving strategy you should know about: the Real Estate Professional Status (REPS). At ZSS CPA, we help clients leverage this strategy to significantly reduce their tax burden and build long-term wealth.

Here’s what REPS is, why it matters, and how it could help you unlock substantial tax benefits.

Under IRS guidelines, qualifying as a Real Estate Professional allows you to treat rental real estate losses as non-passive, meaning you can use those losses to offset active income like W-2 wages, business income, or investment gains.

Normally, rental real estate is considered a passive activity, and losses from passive activities can only offset passive income. That’s where REPS comes in—it’s a game-changer for high-income earners looking for legal ways to reduce their tax bill.

If you’re a high-income professional—such as a physician, attorney, business owner, or tech executive—and also involved in real estate investing, REPS could be a powerful tool for you. This strategy is especially valuable if:

You or your spouse own rental properties.

You’re paying significant income taxes.

You’re open to being more actively involved in managing real estate.

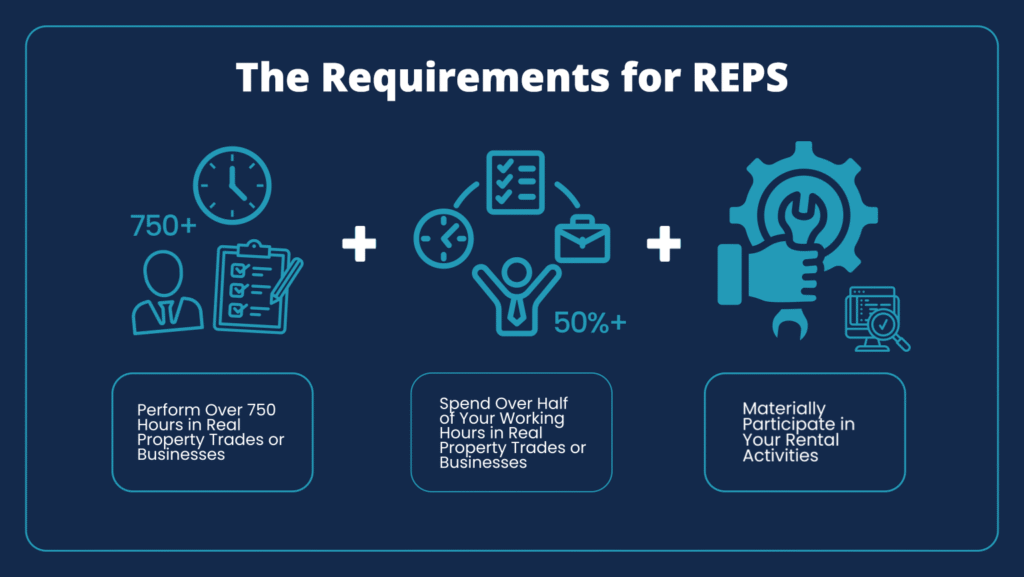

To qualify as a Real Estate Professional, two key IRS tests must be met:

More Than 50% of Personal Services Test

You must spend more than half of your working hours in real property trades or businesses in which you materially participate.

750-Hour Requirement

You must spend at least 750 hours per year performing services in real estate activities, such as property management, acquisition, leasing, construction, or development.

These hours must be documented carefully—this is critical in case of an IRS audit.

💡 Tip: If you’re married, only one spouse needs to meet both tests to qualify. However, that same spouse must also materially participate in the rental activity.

Let’s look at an example:

Say you and your spouse earn $500,000 from W-2 jobs. You also own a short-term rental property that generates a paper loss of $100,000 due to depreciation and other deductions.

Without REPS: That $100,000 passive loss is suspended—you can’t use it to offset your W-2 income.

With REPS: You can apply that $100,000 loss against your W-2 income, potentially saving over $35,000 in taxes (based on a 35% tax bracket).

Multiply that across several properties, and the savings can be substantial.

The IRS scrutinizes REPS claims, so it’s essential to keep detailed time logs and records of your real estate activities. At ZSS CPA, we work closely with clients to ensure they have airtight documentation that stands up to IRS review.

We also help clients decide if it’s worth their time to pursue REPS—or if other strategies (like cost segregation, short-term rental loopholes, or passive grouping elections) might be more appropriate.

Can’t meet the 750-hour rule? There’s another strategy that doesn’t require REPS: the Short-Term Rental Loophole.

If your average rental period is less than 7 days, and you materially participate in the activity, you may be able to claim losses against your active income—even without qualifying as a real estate professional.

REPS is not for everyone. You need to invest time, effort, and be strategic. But for high-income earners with the right setup, it’s one of the most powerful tools in the tax planning toolkit.

At ZSS CPA, we specialize in helping high-income individuals navigate complex tax-saving strategies like REPS. From documenting hours to ensuring IRS compliance, we guide you through every step.

📞 Schedule a consultation today to see how we can help you minimize taxes and maximize your real estate investment returns.

27200 Tourney Road, Suite 290

Valencia, CA 91355-5906

MORE INFORMATION